ADVANCED FINANCIAL ACCOUNTING - MYOB GROUP LIMITED

Table of Contents

| Introduction | 3 |

| Explain qualitative characteristics of financial reporting of Myob | 3 |

| Conceptual framework on AASB | 3 |

| Relevance and representational faithfulness of US corporate financial statements | 6 |

| Fundamental qualitative characteristics | 7 |

| Conclusion | 8 |

| Reference list | 9 |

Introduction

In this globalized era recording and maintenance of financial accounting system has not been maintained manually anymore. Overall accounting system has been maintained digitally. Advance accounting system emphasizes on recording, and interoperate investment and business combinations as well. Apart from this an advance financial accounting system also consolidate subsidiaries, reporting of foreign operation and foreign currency transactions as well

This study focuses on individual factor of financial accounting system with the help of different case study. Incorporation of financial standard and effect of the same has taken in account in this study.

Explain qualitative characteristics of financial reporting of Myob

According to the case study, it has been noticed that CFO (Chief Financial Officer) describes that AASB adoption increases the rate of unmanageable level and it creates an adverse effect on the financial budget. As per the AASB 5 standard, non current status is not followed by the case study as it not provided detail about ceasing of assets or selling assets in order to discontinue the operation of a business (AASB.org, 2018). On the other hand, as per Myob Group Limited finance director, in the case study, it has been seen that training is required before implementing AASB in order to decrease practical skill of the employees in their working area. AASB standard includes separate presentation of each activity in the business and this cannot be conducted by the Australian enterprise due to lack of enough knowledge about the standards of AASB. On the other hand, AASB focuses on the qualitative disclosure of management objectives, policies so that Australian government can provide adequate support to them related to protecting their data in a precise way.

Conceptual framework on AASB

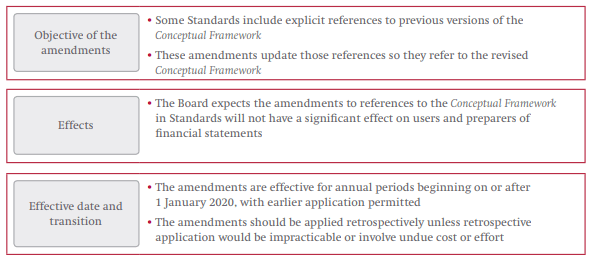

These AASB standards cannot be followed in the case study as their management could not prepare brief report related to their business activities report like investor funds, disclosure of policies that can increase chaotic attitude in the enterprise. Conceptual framework sets different amendments by following the AASB 3 standards so that organisation can estimate their financial errors in a decent way (AASB.org, 2018). On the other hand, it has been noticed that these accounting policies are not revised frequently and it cannot deal all the regulated issues of the organization within short period of time. In this study, it has been noticed that higher authority of the enterprise has several issues in order to accept the conceptual framework of AASB due to lack of effective training and knowledge about it.

Figure 1: Conceptual Framework related to AASB standard in order to set amendments

(Source: AASB.org, 2018)

As per the case study, it has been seen that measurement inconsistency and measurement uncertainty is the main issue that decreases acceptance criteria of AASB in the enterprise. On contrary, it can be said that variability of cash flow decreases creativity of the management of the enterprise and this decreases their economical condition in the recent merchandise community. Thus, higher authority required lot of grooming session based on fair value that is followed by AASB standard so that they can meet current exception based on amount, uncertainty of future cash flow and timing required to conduct any business in a perfect manner. Giner et al. (2016) stated that perfect faithful representation of the equity, liabilities, expenses and income can mitigate the rate of governmental penalties and this also creates a positive effect on the enterprise. It has been seen in the case scenario that US also trying their level best so that they can replace US GAAP and can adopt AASB in order to increase transparency and robustness in their business.

a) Public Interest Theory

Regulation is executed by the society so that they can increase disciplinary behaviour in the recent contemporary community. Dur and van Lent (2018) commented that public interest theory maximises opportunities for the event community and it totally focusers on the public interest and recent trends of the society. It has been seen that financial performance are disclosed by the enterprise and in spite of that they are disclosing their environmental and social factors in an effective way. This disclosure focuses on the rational decision so that the organisation can reduce gap between their modern community consideration and impact of their activities. Public comments in the website need to be considered in order to perform comparison related to survey results and other professional activities. Henceforth, it can be concluded that agents of government needs to disclose all their activities related to their social and environmental factors in order to mitigate queries about legislation in modern community.

(b)Capture Theory

Capture theory deals with the relationship between agencies of government and industrial team so that they can reduce the rate of governmental penalties in a systematic manner. Government agency established rules at state level so that they can manage every issue of the society in a precise way. Gans and Ryall (2017) stated that industry usually follows formal model in order to manage their changes as per their requirement and this reduces gap between modern people’s belief and performance of the industry. Higher authority of the enterprise provides high payment to the high skilled employees so that they can expand their business in recent contemporary community. On the other hand, it had been noticed that agencies of government executes several rules related to quality control, quality control, employee protection standards and different operating activities so that every enterprise in the modern society can get same opportunity to explore them in the modern merchandise community. Regulatory agency established rules by following public interest and it raises resource allocation in the industry based on present demand of modern community. Therefore, it can be said that capture theory aids the agencies to implement policies in such a way so that they can increase satisfaction level of both the employers and common people in the present society.

(c) Economic Interest Group Theory of regulation

This economic interest group theory focuses on promulgate standards so that they can meet expectation of the present individual in the recent competitive market. Cost benefit analysis measures financial condition of the industry by following new regulation along with benefit in recent community of Australia. Perfect review based on cost benefit analysis is performed by the governmental agents in order to raise cost benefit and eliminate negative issues from the strategy in an innovative way. Koopman et al. (2014) argued that government agent deals with the consumer protection welfare by following public interest theory so that they can bring power in economy and raises contentment level of the common people. It has been noticed that human trends are changing day by day. Thus, it becomes very critical for the government to prepare long sustainable strategy in order to bring economic stability in a decent way.

Relevance and representational faithfulness of US corporate financial statements

US financial Accounting Standard Board does not allow revaluation of noncurrent asset at a fair value but impairment of asset is mandatory. Thus, in order to prepare a representational faithfulness of US financial statement the required implementation has discussed below

Long lived assets must be disposed of by sale. As per the FASB accounting standard Impairment of long lived asset must be disposed off (Fasb.org, 2018). It also eliminate the requirement of good will thus allocation of god will in the long lived asset and impairment test of the same is equally important. Establish of a primary asset approach also helps in representing faithful financial statement at the end of a financial period. As per the accounting model if the long lived asset cannot be revalued then it can be disposed of by sale it after using that asset for a specific period of time.

Representation of financial statement can be made more faithful by implementation issues must be resolved in the financial statement. It is possible by establishing criteria beyond the previous specified statement. This issue can be solved either by making immediate sale of asset or selling the asset at a future period. The sale of asset can be probable and should be transferred in order to ensure the quality for recognition (Ackerman et al. 2014).

Incorporation of the above mentioned features can be benefited for a faithful representation of US financial statement for not consideration of revaluation of asset. Moreover it can be determined that incorporation of these features are can be replaced the area of non revaluation of asset.

Fundamental qualitative characteristics

The term revaluation can be defined as an act of recognition and reassessment of carrying value of a non current asset to the fair value of asset with in a particular time period but does not include recoverable amount of asset and impairment loss. As stated by McCluskey and Franzsen (2017), fixed asset of an organization can be revalued in two different ways such as under upward and downward method. Revaluation of asset under upward revaluation method can leads upon the value of asset and total value of shareholder’s equity from the balance sheet of the company. Mark to market accounting approach refers to the recording the value of an assets to reflect its current market level. In the annual statement it must reflect the current market value. For instance in a company of financial service industry require to take the adjustment to their asset accounts. As commented by Beatty & Liao (2014) thus when these loans are recorded as bad debt the companies need to mark down their asset to fair value. Mark to market has also been seen during lending or issuing bonds to lenders and investor. However there is a high risk in performing Mark to market accounting approach. The main risk is when it does not accurately reflect the underlying asset value.

Thus, as a result financial leverage ratio of that organization dropped down. Plant, equipment, land has considered as noncurrent asset because it have been purchased by a firm with an intention to use asset for a longer period of time. Noncurrent asset plays an important role to maintain balance of an organization because these are not resalable at a normal course of action (McCluskey and Franzsen, 2017). In order to make a sell of noncurrent asset of an organization revaluation of asset is important because it helps to determine the current value of the asset. Many organizations have elected not to measure property, plant, equipment at a fair value. Cost Model of asset get more preference than using revaluation. The main responsible factor in this is a higher amount of cost is involved in revaluation. Therefore, cost leads to increase in the value of expense and that eventually effects on the fall of net profit. Moreover cash flow value of the organization has dropped down in the financial statement. This is the main reason that motivates managers not to revalue plant, property and equipment.

b) Effect of non revaluation of asset in the financial report of the organization

Revaluation is a financial method that helps to disclose the true asset value of an organization. As per the comments of Pijper (2016), revaluation of asset also helps to determine possible amount of return from capital investment. Thus, non revaluation of asset has a strong impact on financial report because company does not disclose the real value of asset and it has fall an impact on the tax factor of the organization. Thus, it has fall an inverse impact on the managerial decision of the company.

c) Adverse effect this on the wealth of shareholders

Non revaluation of asset directly leads to increase or decrease in the shareholders equity value. Shareholders wealth is the net present value of the expected future return to the owner of the firm. The return mainly derived from periodic dividend payment by the organization (Ahmed and Safdar, 2018). Thus, measurement of shareholders wealth depends on present market value of the noncurrent assets. Thus, in order to determine present value of noncurrent asset revaluation is one of the essential requirements. Furthermore, director’s decision not to revalue of asset fall a negative impact on the shareholder’s wealth because actual value of asset cannot be determined.

Conclusion

It can be concluded from this study that manual accounting system has replaced by advanced accounting system. AASB standard 5 and AASB standard has discussed in this study in order to incorporate managerial issues. From the analysis it has been seen that company is not able to follow AASB standard because of high complication in the standard and it also creates a barriers in the managerial way of organization. The present report structure will focus the advanced accounting techniques and measurement of Enron’s management. Enron’s management is a leading company in Australia which provide the natural gas. However there has been a scandal occurs in Enron’s management for which the entire operations have shut down. This report aims to evaluate and analyse the main causes of the fall of Enron’s management. Following evaluation can be possible by analysing the measurement methodologies and its element. Its financial reporting style and techniques also be reviewed to find the main loopholes for the shutdown of the company. On the other Trading business pattern and Mark to market accounting will be analysed in this report. As per the US Financial Accounting Standard Board, it is not important to include revaluation of asset instead impairment of cost has accepted as per this standard. Thus, further implementation areas have been suggested for relevance and representational faithfulness in US corporate financial statements. The reasons for not incorporation of revaluation of fixed asset has discussed in this study. Overall cost can be increased. Effect of non revaluation of asset in the financial statement has also discussed.

Reference list

Ackerman, P., Belbo, H., Eliasson, L., de Jong, A., Lazdins, A., and Lyons, J. 2014. The COST model for calculation of forest operations costs. International Journal of Forest Engineering, 25(1), pp.75-81.

Ahmed, A.S. and Safdar, I., 2018. Dissecting stock price momentum using financial statement analysis. Accounting & Finance.

Dur, R. and van Lent, M., 2018. Serving the public interest in several ways: Theory and empirics. Labour Economics, 51(6), pp.13-24.

Fasb.org. 2018. ACCOUNTING FOR THE IMPAIRMENT OR DISPOSAL OF LONG-LIVED ASSETS (ISSUED 8/01) Available at: http://www.fasb.org/summary/stsum144.shtml [Accessed on 25 March 2018]

Gans, J. and Ryall, M.D., 2017. Value capture theory: A strategic management review. Strategic Management Journal, 38(1), pp.17-41.

Giner, B., Hellman, N., Jorissen, A., Quagli, A. and Taleb, A., 2016. On the ‘Review of Structure and Effectiveness of the AASB Foundation’: the EAA’s Financial Reporting Standards Committee’s View. Accounting in Europe, 13(2), pp.285-294.

AASB.org (2018), Conceptual Framework for Financial Reporting, Available at: https://www.AASB.org/-/media/project/conceptual-framework/fact-sheet-project-summary-and-feedback-statement/conceptual-framework-project-summary.pdf [Accessed on: 15th November, 2017]

AASB.org (2018), List of AASB Standards, Available at: https://www.AASB.org/issued-standards/list-of-standards/ [Accessed on: 4th October, 2017]

Koopman, C., Mitchell, M. and Thierer, A., 2014. The sharing economy and consumer protection regulation: The case for policy change. J. Bus. Entrepreneurship & L., 8(3), pp.529-658.

McCluskey, W.J. and Franzsen, R.C., 2017. Land value taxation: An applied analysis. Routledge.

Pijper, T., 2016. Creative accounting: The effectiveness of financial reporting in the UK. Springer.